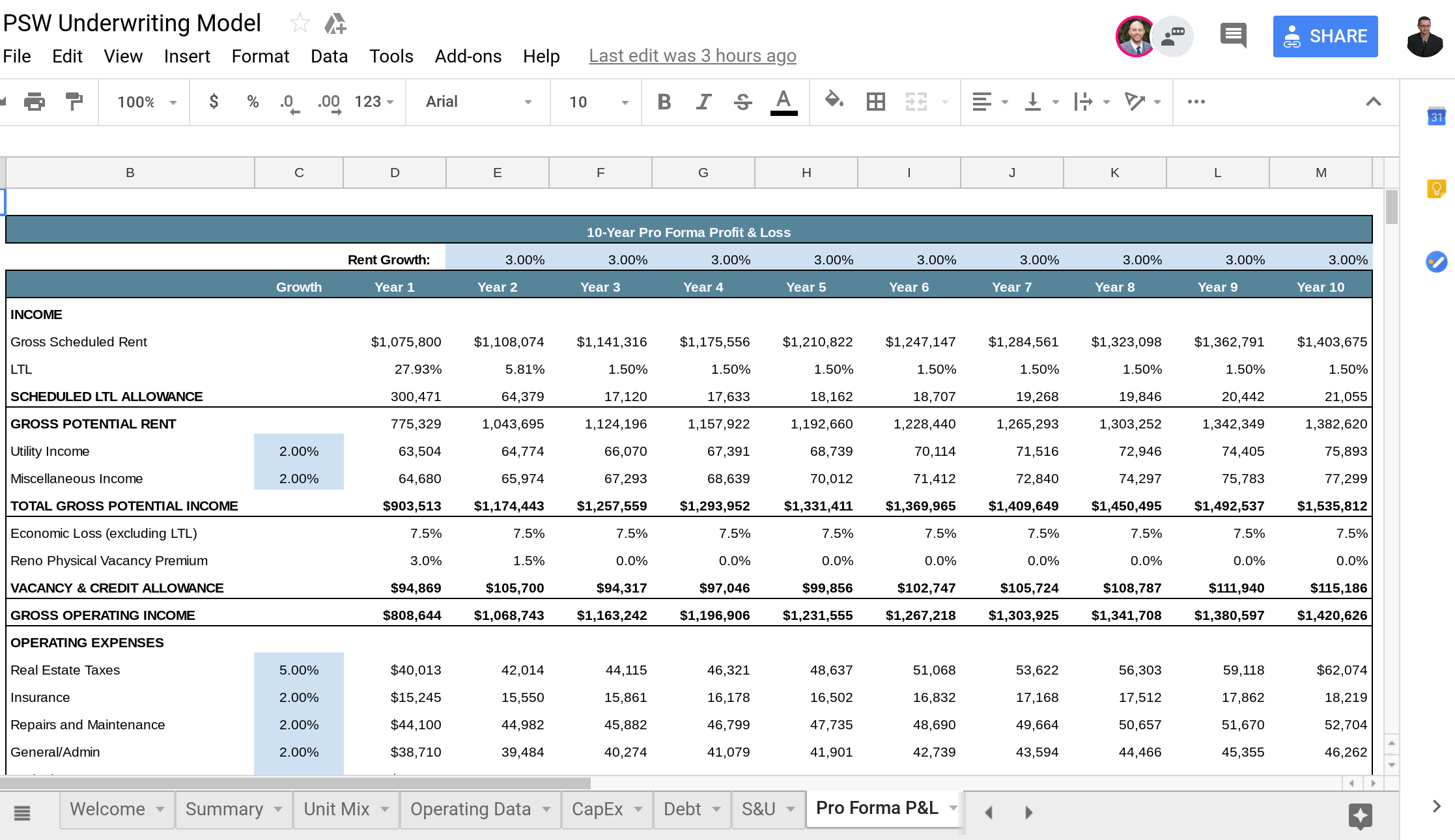

Yesterday in I announced the Phoenix Syndication Workshop. Today, a very short but powerful announcement: Registrations Processed Prior to October 15th Receive PSW Multifamily Underwriting Model FREE Extremely Powerful Tool I promise you this is the best underwriting spreadsheet your money can buy. Only you get it for free by registering prior to October 15th. Not […]

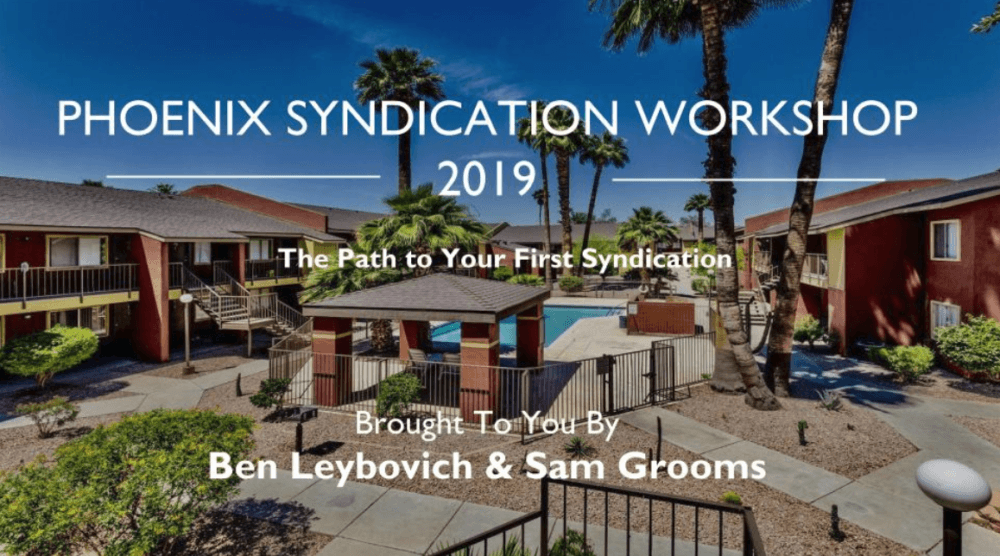

Phoenix Syndication Workshop

Phoenix Syndication Workshop If you follow me you probably already know about this. But just in case: On January 26th and 27th my partner, Sam Grooms, and I will hold a 2-day event in Phoenix called the Phoenix Syndication Workshop. I am SUPER excited about this for a number of reasons: We Will Shorten Your Learning Curve […]

Most Important Concept in Real Estate

Multifamily Loan Options for Syndications

There are only three, globally-speaking, options for the type of loan we can get for multifamily. The main distinction comes down to the state and condition of the property itself. Let’s discuss. Portfolio Loan Portfolio loans are loans you can get from a local community bank. These banks are small banks with several locations that serve specific […]

What Are the Economic Losses in Apartment Investing

As it relates to things that cost money on a monthly and annualized basis in apartment investing there are two categories of items – those that you stroke a check for every month or year, and those that you don’t. The “stroke a check” category is easy to understand. The money was in your account, […]

What’s Better, 30 units with $600 rents or 15 with $1,200 rents

This was a question that came up in the comment section of the latest article I wrote on BiggerPockets. The answer may surprise you. What’s Better, 30 units with $600 rents or 15 units with $1,200 rents Let’s tackle this question in two ways because we are discussing two separate elements here, unit count and rental […]

$8.15M Acquisition Closed!

Ladies and Gents, I am very excited to announce that we just closed on The Silver Tree, a 98-unit value add in Phoenix MSA. This was an $8.15M acquisition, requiring a $1.3M renovation. The asset was constructed in 1984, with a great unit mix of Studio, 1×1, 2×1, and 2×2. This was a private placement with […]

Underwriting Multifamily the Right Way, Part 1

Few phrases are more irritating in the world of real estate than, real estate is all about the numbers. Real estate is as much about the numbers as a painting is about the paint, or a book is about the letters. Letters are needed to write a book, to be sure. And paints are needed in order […]

Multifamily Underwriting and Personal Growth

I am super excited to tell my story today. I am very proud of the story I’m about to tell you, and I think there are meaningful lessons to be had here for all of us. What I’ve Been Up To I’ve been a little silent as of late. I am sure you noticed. The […]

Real Estate Investors – Challenges, Naysayers, Uncertainty, and Doubt!

Being a real estate investor is full of challenges, naysayers, uncertainty, and doubt. You have to deal with contractor and tenants, both of whom are prone to temper-tantrums. You have to deal with local regulatory authorities, which can get redundant. You have to deal with failures, because things often don’t work as intended or planned. Real […]

What’s More Important for Rentals – Equity or Cash Flow?

When I decided to write 100 articles answering 100 most often asked questions, and began compiling what those 100 questions might be, it occurred to me that some of the questions are that should be on the list, aren’t. I think folks assume that the answer is very straight-forward, and those questions never come up. […]

How Does Inflation Impact Real Estate Investing?

One of the reasons rentals are such an amazing investment vehicle is because they are inflation-protected. Here’s how the thinking goes: Monetary Inflation’s Impact to Investment Properties In our economy, certain amount of currency chases certain amount of products and services. The amount of currency can increase, without causing damage to the economy, only if […]

What is a Real Estate Investment Pig?

I’ve addressed the concept of PIGs in real estate in many articles previously. The concept is somewhat abstract, and seems to be quite misunderstood still, in-spite of me addressing it on multiple occasions. Just this morning I received an email to this end. The email was from a gentleman considering a vacant 4-plex. He wrote […]

How to Write a Lease for Roommates

If I were to make a list of 100 most commonly asked questions, this one would certainly be on it – how to write a lease for roommates. Indeed, just yesterday this subject came up in conversation on social media, and folks were quite engaged. As you know, I am not an attorney, so don’t interpret […]

Should Tenants Pay the Utilities?

Utilities used to be a token cost. Natural heating gas was cheap. Electricity was cheap. And water was literally nothing. Today, all of these have inflated dramatically, to the point that in some markets they have outpaced rent growth by a significant clip. With this in mind, as investment property owners we have to be […]