I am not sure if we are the only ones doing this, but in the Leybovich household we have monthly board meetings. My wife Patrisha is the president of the board. Our white lab by the name of Sladky is the secretary. While kids and I just raise our hands to ask questions, which Patrisha can answer and Sladky can then record for posterity with a bark of approval.

Well, a few days ago we were having a board meeting while taking an evening stroll – all five of us. And, I asked a question:

Was it worth it to buy rental property?

I was referring to all of the time and energy that I am having to spend on management of my most recent acquisition. You may know, I’ve written about this in some of my other articles, that in February of this year I bought a 10-unit apartment building. Though there is nothing wrong with the building itself, the tenant base that I inherited was some what problematic due to a very lacking qualification process of the previous owner.

In short, I knew that I’d have my hands full, and I do… I’ve turned over 4 units in 6 months, and I am not done for the year…I am definitively earning my stay.

So – what did Patrisha Say?

Patrisha, without blinking an eye blurted out a truism that I know so well, but in the heat of battle sometimes forget:

“We have to stretch in order to grow. What you are doing now will pay for our retirement – sooner rather than later….”

WOW, yes it will – thank you baby for reminding me of this! And in case you guys are wondering, here’s what I am doing:

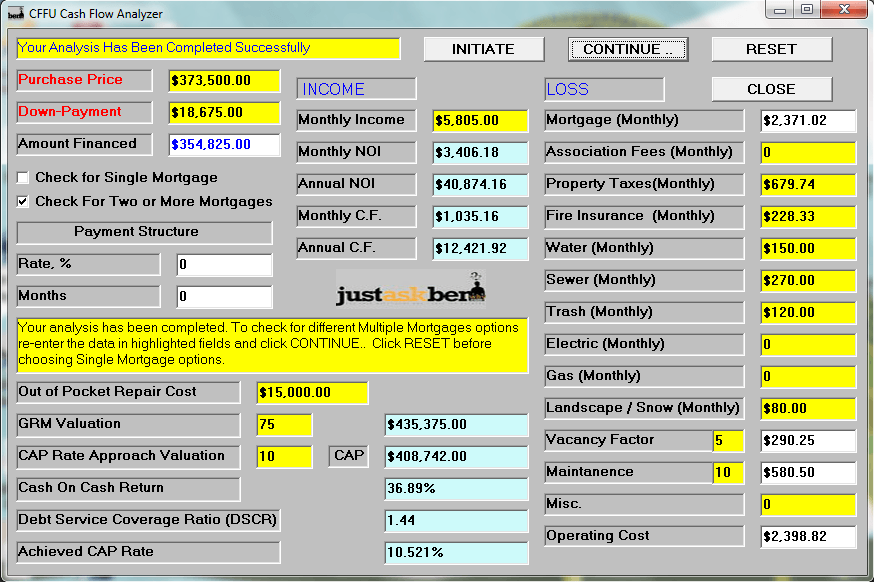

At the time of acquisition, this was the financial statement of this building. By the way – you are looking at the screen-shot of the last frame of my CFFU Cash Flow Analyzer software which comes as part of the Cash Flow Freedom University.

I could write 40 pages about what you see in this screen, but what I want you to notice now is the Monthly C.F. (cash flow) of $1,035.16. This was indeed the scheduled Cash Flow at the time of acquisition.

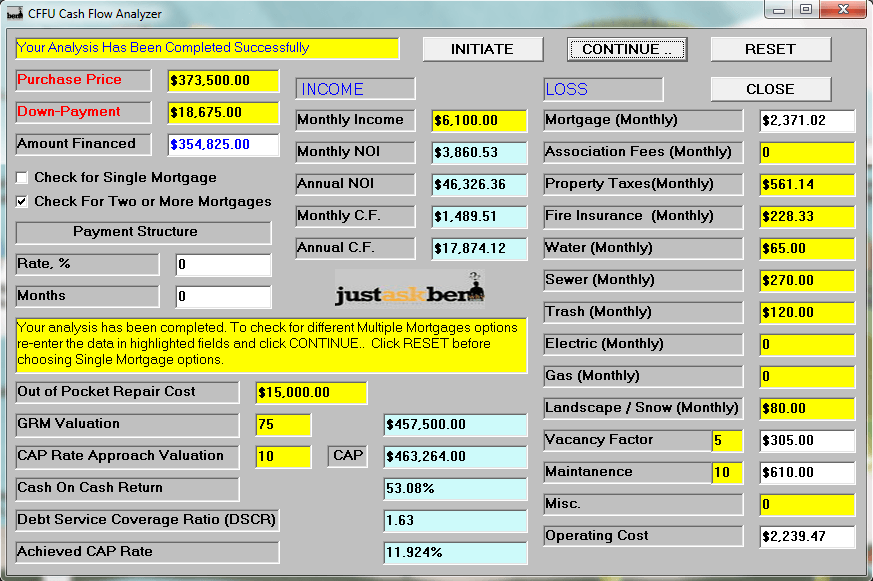

In that I’ve been working hard, here’s how things look right now:

Notice that the Monthly C.F. is now up to $1,489.51, which is about an $450/month increase. And, this is with only 4 units turned over.

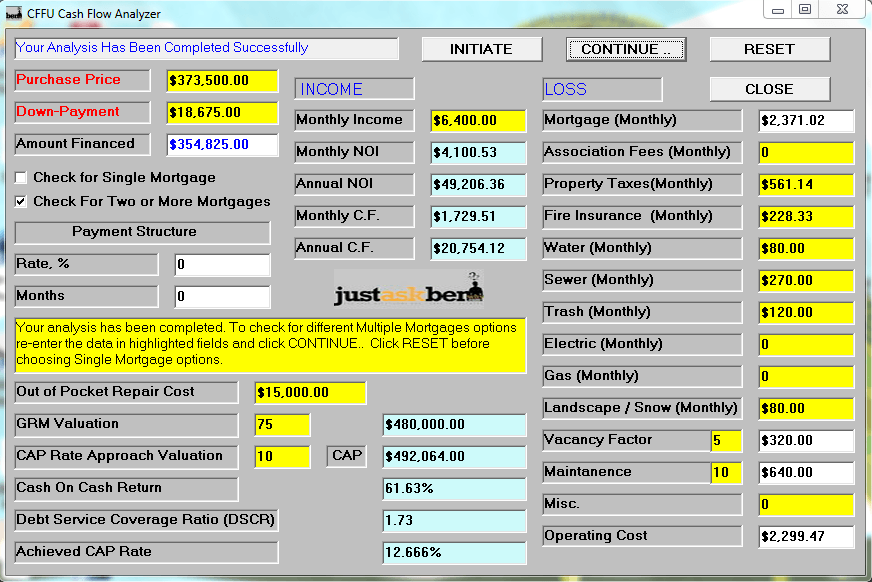

In another year year and a half, once I’ve had an opportunity to do what needs to be done with the remaining 6 units, this will be the financial statement:

Thus, I am working very hard to re-invent a good investment into a great investment. I bought a building which was putting $1,035 in my pocket every month, but through the work that I am doing now, the same building will be putting $1,700+ in my pocket every month (it’s likely be closer to $1,900 actually).

The work is worth it – wouldn’t you agree? My wife is right…we have to make ourselves uncomfortable in order to move forward.

What do you think guys? Leave me a comment – let me know 🙂

UPDATE: Want to know how this project has turned out? Click here…

Photo Credit: Alan Cleaver via Compfight cc

13 Comments