In the past couple of years I’ve written a number of articles which dissected the one of my acquisitions from 2013. I coined this transaction the Symphony Deal, and it is a turn-around of a 10-unit apartment building that I purchased in February of 2013. I set out to write about this transaction because it encompasses a lot of the core principles behind making big money in real estate investing.

In the past couple of years I’ve written a number of articles which dissected the one of my acquisitions from 2013. I coined this transaction the Symphony Deal, and it is a turn-around of a 10-unit apartment building that I purchased in February of 2013. I set out to write about this transaction because it encompasses a lot of the core principles behind making big money in real estate investing.

The first article in this series was entitled How to Build Wealth with Rentals – A Case Study. I posted it on this blog on January 5th, 2014, or about 1 year following the acquisition. In this article, I described my underwriting process for this deal, what I saw in terms of value add, and what ended up being my eventual business plan for Symphony. I also provided you with some of the details behind my acquisition plan relative to the financing.

One year later, on December 23rd 2013, I updated you as to the progress that has been made in an article entitled How to Make Money in Real Estate Investing – Symphony Case Study Continued. In this follow-up article, I was able to provide you with a progress report after 2 years of ownership, and outline the strategic options going forward.

Well, I hadn’t planned on writing a follow-up until next year, but there’s been material change in the status of the building recently. So, here comes the next installment…

Background

Please read the previous articles for all of the details. For your convenience, they are linked – just click on the the links.

Just to set the scene, for those of you to whom this is the first exposure to the Symphony Deal, Symphony is comprised of two 5-unit buildings sitting next to one another at the end of a dead end street. It’s in a C Class subdivision, which is made into a B- Class by the fact that lies in one of the two most desirable school districts in my town.

The buildings were constructed 1980. The units are all 2-story town-homes. There are two different lay-outs; all units are 2-bedroom, however, some are 1 bath with a large kitchens, while others are 1.5 bath with smaller kitchen and a dining room. The units are all-electric and are sub-metered. The water service is sub-metered to each unit as well. The sewer and garbage are billed to the owner.

The buildings were constructed 1980. The units are all 2-story town-homes. There are two different lay-outs; all units are 2-bedroom, however, some are 1 bath with a large kitchens, while others are 1.5 bath with smaller kitchen and a dining room. The units are all-electric and are sub-metered. The water service is sub-metered to each unit as well. The sewer and garbage are billed to the owner.

I purchased Symphony for $373,500. My financing package included a commercial portfolio note for 70% of the purchase price, and a private note for 25% of the purchase price. The portfolio note was collateralized solely by the subject property, while the private note was cross-collateralized with a blanket.

This left me having to come up with 5%. However, after all of the pro-rations and credits, I needed only about $5,300 out-of-pocket to close. Symphony was bought for $373,500 with 1.5% out of pocket – not exactly 100% financing, but might as well had been…

At first, I wasn’t Making Big money in Real Estate Investing!

In fact, there were moments when I was starting to doubt the validity of my decision-making process around this deal. Indeed, in the first 11 months of ownership, I was able to cash flow a miserable $3,000. I had evictions, turn-overs, and had to absorb about $15,000 of CapEx. My Gross Potential Income was too low, and my Economic Losses were high. Sure, all said and done I broke even for the year, and even made $3,000 positive cash flow in 2013, but this sure as hell wasn’t why I bought the building – I wasn’t making big money in real estate investing. Things needed to get better, or I was going to feel pain…

In 2014, however, things did get better indeed. I was able to Cash Flow $12,000. I only had to evict once in 2014, and only spent $7,500 on CapEx – I was getting a hold of the delayed maintenance in Symphony, and my hand-picked tenants were behaving much better than those whom I inherited from the previous owner.

Thus, in 2014 I cash flowed $1,000/month on an annualized basis on a fully leveraged transaction – that’s $100/door/month.

For more details on how the past two years took shape, please follow the links above.

The Update

What has changed recently, and serves as the reason behind this article, is that last week I closed on a refinance of this project. Symphony appraised at $450,000, which meant that I was able to wrap the existing 1st with the private blanket into one fully amortized loan.

2015 Projections

First, this refinance lowered my monthly debt service by about $135/month. This is $1,600+ of annual Cash Flow that I didn’t have to work for. If I maintain $12,000 baseline Cash Flow in 2015, which is more than reasonable at this point, the savings due to the refinance should push me toward $13,600 CF for the year; $113/door/month.

Additionally, in 2014 I spent about $7,500 on CapEx. A 1980 building should not need $7,500 of CapEx every year. I’ve replaced the roofs, most of the flooring, and a lot of the plumbing. If I can run this think on $5,000 of CapEx in 2015 ($500/door), there’s another $2,500 of Cash Flow.

Symphony hadn’t had a vacancy in 6 months; it is stable. In short, if I am able to control CapEx at $5,000 in 2015, I should be able to see Cash Flow in the range of $16,000; $133/door/month.

Finally, and this is just a side-note, my new debt is $351,000, which means that I get to stick $100,000 on my balance sheet. But, that’s incidental…

Making Big money in Real Estate Investing – What Is the IRR?

The internal rate of return is how we should underwrite income-producing deals. The IRR tracks all of the income and expenses while assigning value to time. It also necessitates that we project the exit, since the capital gains on the back end is one of the income streams.

With this in mind, in order to calculate the IRR on Symphony I’d have to anticipate an exit. The issue with that, however, is that it’s not immediately apparent to me what the am I would do with the money that would generate comparable returns?! In 5 years Symphony will put as much in my pocket via CF as it would if I sold for capital gains, and considering I have no money in the deal, even if adjusted to NPV (net present value), those cash flows are more than anything I can do with the proceeds from the sale.

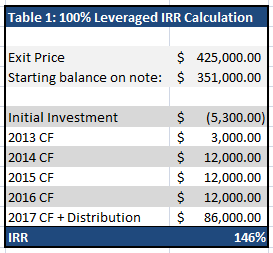

But, just for conversation’s sake, let’s figure out the IRR if I were to sell in 2017, having held the building for 5 years. We will assume a sale price of $425,000, which is $25,000 under the current appraised valuation. Let’s also assume cash flows going forward of $12,000, though, as I stated above, I think I can do better. Finally, let’s not take into account any principle pay-down, since if we did that, to be fair we’d have to take into account recapture of depression, and that’s more than the scope of this article intends to outline. Thus, the distributable capital at the end is sale price less the starting balance, with $12,000 CF for that year added in (assuming I sell in December):

The IRR is 146%!

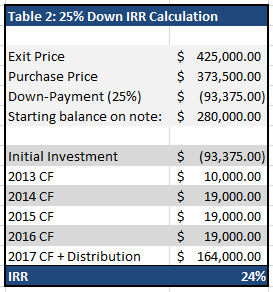

What you need to understand is that the reason the internal rate is so high is mostly due to a very low cash investment at the front door. Just to demonstrate the difference, let us construct an IRR projection on the same property, but with a 25% down-payment. This would mean a much higher initial investment, but also higher cash flows throughout due to the fact that because of the down-payment the debt (and debt service) is much lower, resulting in higher cash flow:

Conclusion

While 24% IRR is in reality extremely competitive, I hope that you can see the benefit of no-money-down. However, deals like Symphony are extremely rare – deals that can support 100% financing and that are worth owning are very far and few between, which is why I average 1 deal per year.

Hope you enjoyed this article. Please feel free to leave questions and comments below…

8 Comments