This article is for those of you who are interested in understanding the inner workings of real estate investing – why it works, how it works, and how you can use it to achieve financial success! This article is for those who want to know the truth about how to make money in real estate investing…

This article is for those of you who are interested in understanding the inner workings of real estate investing – why it works, how it works, and how you can use it to achieve financial success! This article is for those who want to know the truth about how to make money in real estate investing…

INTRODUCTION

Almost exactly one year ago I shared with you a case-study of one of my acquisitions. The article was titled, How to Build Wealth with Rentals – A Case Study, and in it I outlined my basic philosophy around real estate investing, why I believe it works so well, what the pitfalls are, and what the opportunities are. To illustrate my points I set the scene as a case study of an acquisition of a 10-unit apartment building – I called it the Symphony deal.

At the time I wrote the previous article, I had been owner of the Symphony 10-unit for about one year. Let us now briefly recap the highlights of what was previously said, specifically as it relates to the numbers in the transaction. But please, if you haven’t read that article please click here. I will not spend time on many of the specifics here, since my intention for this article is to pick up where I left of 12 months ago. I do think, however, that in order to fully appreciate the points I make today, you should indeed familiarize yourself with all of the details of the previous article…

THE SYMPHONY DEAL

As you remember, the Symphony 10-unit is actually two 5-units sitting next to one another, just like this:

The buildings were constructed in 1980. They are, as you can see, 2-story.

The units are town-homes, of which 4 units are 2-bedroom 1.5-bath, and 6 units are 2-bedroom, 1-bath. The buildings are all-electric, and both electric and water services are separately metered. The owner is responsible for sewer and trash.

I could see a fair amount of deferred maintenance, however exactly how much did not become clear until later…more on that in a bit.

FINANCIALS at ACQUISITION

As I told you in the previous article, the projected Gross Income at the time of acquisition was $5,805/month and the NOI (Net Operating Income) was $3,406/month. It is important to note at this time that there is a big difference between projected and actual financials. Projected numbers are what we refer to in real estate investing as Pro Forma – it is numbers that we anticipate and that we use on paper or excel spreadsheet to build or model for the investments. These projections are not real until they’ve been proven. However, we have to start somewhere, and having done my research those are the numbers I came up with.

I paid $373,500 for Symphony, and of that I was able to finance a total of $354,825, which represents 95% LTV. For those who may not know, LTV stands for Loan to Vaue – it’s a number which juxtaposes the amount of financing against the value of the asset materializing said financing. Most often, when the financing is for a brand new purchase, the purchase price defines the value. Thus, in my case, since the purchase price was $373,500, and the total amount financed was $354,825, this relationship is 95%, since $354825 is 95% of $373,500.

My financing package included an institutional portfolio loan for 70% of the acquisition price, and a private second position loan in the amount of 25%. Both of these loans combined totaled $354,825, which left me with having to come up with the difference of $18,675 (5% of the purchase).However, after all pro-rations and credits I came to closing with around $5,300…

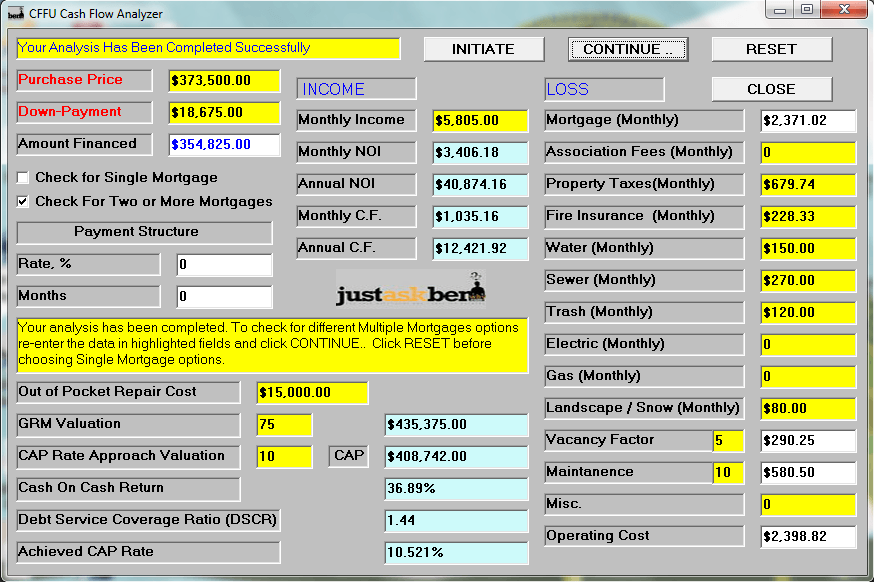

With my financing in place, the Pro Forma Cash Flow after debt service stood at about $1,035/month – basically $100 per door. Below is the screenshot of the CFFU Cash Flow Analyzer, which is an analysis software I designed and used to evaluate the Symphony transaction. It’s actually a pretty handy tool, and it comes as part of the Cash Flow Freedom University:

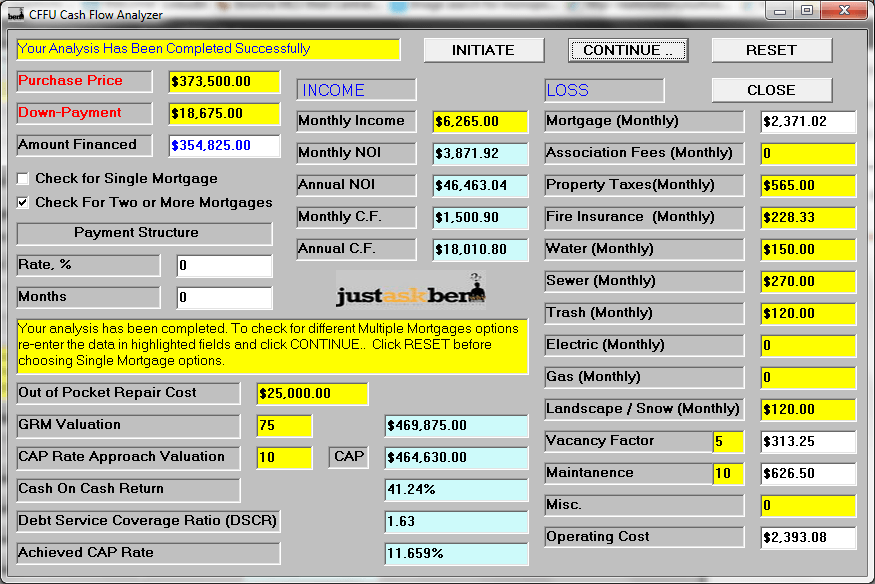

Furthermore, I anticipated that by raising rents and lowering costs, I’d be able to push the cash flow to around $1,500/month:

This was my plan; this was how things looked on paper. Let us discuss in real terms now how to make money in real estate investing…not on paper – not projections, but real stuff!

CASH FLOW AFTER 11 MONTHS OF OWNERSHIP – THE REALITY

I bought Symphony in February of 2013, which meant that I had the building in my portfolio for 11 months in 2013. Would you like to know how much real cash flow I made on Symphony in 2013? I am not talking about Pro Forma numbers here – this is the real deal.

Hold onto your nickers – having done my P & L as part of my tax reporting, it became painfully clear that in the first 11 months of ownership I made a whooping $3,000 on Symphony. That’s right, not $18,000, as I’d hoped, and not even $12,000, as I projected – $3,000 was all I got for my efforts in that first year.

In addition to normal turn-over, I had to deal with more evictions than I anticipated, the first of which took place in the very first month. These evictions were accompanied by more repairs and more months without rental income than I ever thought possible. I had CapEx expenses to rectify deferred maintenance issues in the tens of thousands of dollars, a lot of which happened with much more speed than I’d planned. I knew when I bought Symphony that I’d need to spend money to rectify delayed maintenance issues, but I planned to do it over a couple of years by recycling my cash flow. This wasn’t how it turned out…

I essentially broke even in the first year, but only barely. I remember thinking – why do I bother?! $3,000 of profit on a building which looked as though it was going to make $1,000/month – WOW!

I have to tell you that while I did anticipate significant head-winds, what actually transpired was a whole lot more painful than anything I’d imagined beforehand. Perhaps you can extrapolate from this for your own benefit…

But, with this we enter Year 2:

HOW TO MAKE MONEY IN REAL ESTATE INVESTING

Well – the bad news is that in the second year I am still not at the $18,000 of Cash Flow, as the above Pro Forma would indicate, and I don’t know if Symphony will ever get there. However, I did do a lot better this year, and I do think that in year 3 will indeed have a fighting chance to get most of the way there.

As I am writing this article in December of 2014, according to the T12 P & L my cash flow on Symphony stands at right around $12,500. This means that the cash flow in 2014, the second year of ownership, was at about $1,000/month, which is what my Pro Forma analysis indicated as the bare minimum at the time of acquisition – I’ve made my way back to even keel. Better late than never, but it sure wasn’t all fun… And, I haven’t really made any inroads into any value ad relative to rents…

THERE IS SOME GOOD NEWS

First of all, even if what Symphony did in 2014 (meaning $12,000 of cash flow) is in fact the best that the building is capable of, it’s not a terrible thing. Remember, Symphony was financed virtually 100% with only $5,300. I think you would agree that to own a building capable of generating $12,000 of free cash flow with having only made a down-payment of $5,300 is not too bad of a deal…

As I mentioned, however, I do in fact think that in year 3 I’ll do better. Here are a few pieces of information you need to know:

CapEx

First of all, you need to know that in 2014 I had spent about $7,500 on CapEx items. What is CapEx – it is big-ticket delayed maintenance items, or capital expenses, which have to be rectified if the building is to continue operating as designed; no other way, unless you are going to be a slumlord… These items included things like roofs, windows, appliances, HVAC, water tanks, flooring, cabinets/counter tops, etc. Well, having spent about $15,000 on these CapEx items in 2013, which is why my cash flow was a misirable $3,000, I spent half of that in 2014.

Notice, there are no cheap items on this list, which is precicely why too often apartment owners do not keep up with CapEx. Having not accounted for these expenses comning out of the cash flow, investors often pay too much for the asset. Had I underwritten the building any less conservatively, I could have found myself in the red at the end of 2013 – extrapolate that!

As it is, however, having spent $7,500 in 2014 and double that in the prior year, I am obviously on the right trajectory to get control of the delayed maintenance. Normal operating levels of CapEx for a 1980 building such as Symphony should be in the range of $350 – $500/door/annum, meaning that once the deferred maintenance is caught up, I really shouldn’t be spending any more than $5,000 – $6,000 on CapEx per year. Once there, this should add at least $1,500 annually to Symphony’s cash flow, bringing it up from the current $12,500 to at least $14,000. I do think that this is very achievable in 2015!

Also, looking at the P&L, Patrisha and I know exactly what the problems were in 2014 – we know which units/tenants caused issues, and we think we can make progress on those in 2015. We think that we left about $3,000 of cash flow on the table, and if we assume conservatively $1,000, the cash flow in 2015 should look more like $15,000.

Obviously, though, even this will still fall short of my projection of stabilized cash flow of $18,000. Though, I do still have another trick up my sleeve 🙂

Financing

Understand, financing Symphony at 100% came at a price. My payment on the second mortgage runs right around $700/month, which is steep. The good thing is that once that’s cashed out, the $700/month ($8,400/year) will stick to me in the form of additional cash flow. That, in and of itself, would get me to $20,000/year CF based on 2014 numbers.

Those are big Cash Flow numbers for a little B Class 10-unit that I bought with $5,300 cash out of pocket. This would be nice – but how do I make that second mortgage disappear…?!

Well – I have 2 options:

- I can just pay it off organically. I still have 5 years left on the 7-year balloon, and I can do this by throwing some cash at it every month. However, while certainly possible, this is not my favorite approach. I just would prefer not to throw so much cash at it; with 5 years left I would have to allocate about $1,500/month to do this, and while my portfolio can certainly handle it, I’d rather put the money in my pocket…

- Another option is to refinance the building with a fully amortized note large enough to wrap both mortgages together, thereby alleviating the necessity to throw money at it. Doing so, however, is a function of 2 things. One – my portfolio has to qualify relative to cash flow. And two – Symphony must appraise for high enough.

Well – a local lender just proposed to refinance this building at 80% LTV based on an appraised valuation. At 80% LTV, if Symphony can appraise for $450,000+, which I think that it will, I should be able to wrap the balances of the first and second mortgages into a permanent note. What’s more, since the interest rate that I’m paying on the private second is understandably so much higher than the proposed permanent financing will be, I will actually lower my cumulative annual debt service by about $1,50o, all of which will show up in the cash flow, bringing it in the $17,000. For a number of reasons, even though I’ve been given a soft approval by the bank committee, I am waiting to take action on this refinance until early 2015.

So, to sum up the financing situation, if I am able to refinance, then I will not need to make payments of $1,500/month with which to organically amortize the second mortgage, and I will likely free up an additional $125/month of Cash Flow. However, all of the existing debt will stay with the property; it’ll simply move it from second position private note, to the institutional permanent note.

On the other hand, if I cannot refinance, then for the next 5 years I’ll allocate $1,500/month to paying the note off organically. And while it’ll be sort of difficult to swallow, so to speak, after 5 years I will regain the entire $700/month that the note is costing me, instead of only $150, plus add almost $100,000 of equity to my balance sheet.

While I prefer the second option because it allows me to keep cash in my pocket today, which, relative to the principles of time value and IRR is much better for me, at the end of the day both options are viable and doable. Important to underscore, as well, is that whichever way things turn out, I’ve already won, the process is automated at the high-level, and it’s not contingent on the market behavior. I don’t need to hope for organic appreciation of either rents or property values in order to work the plan – either plan. It’s done!

Not a bad place to be…

THIS TAKES TIME

Guys, Symphony has been the best deal of my career thus far. What’s more, I’ve learned so much during the trials and tribulations over the past two years that I can absolutely state that my next deal is going to be even better. Intellectual worth is in large part a matter of perspective, and perspective only comes with time and experience.

Indeed, I could not have done Symphony 5 years ago; I could not have wrapped my brain around all of the moving parts that a deal of this size requires. The good news, however, is that I did not have to. Smaller deals were good for me early on; they were good for learning the ropes and developing perspective. And another good thing (good for you, that is) is that perhaps you don’t need to make all of the mistakes that I’ve made – you can learn from mine!

And with this, I am excited to announce that for a limited time (3 days only: January 21 -23) the Cash Flow Freedom University will be on sale at 20% OFF. Many people will tell you that at the regular price of $295 CFFU represents the best real estate education of its’ kind available on the internet – please read the reviews here. And at a 20% discount CFFU it is flat out a steal.

For the price of $236, you will gain immediate access to all of the materials which include 22 MP3 files totaling almost 18 hours, 200+ pages of PDF files, and the CFFU Cash Flow Analyzer software, which I used to analyze Symphony:

Money-Back Guarantee!

Money-Back Guarantee!

And, as always, CFFU comes with a 30-Day no questions asked guarantee. Simply-put, if having purchased CFFU you don’t think that the content is worth the money you’ve paid, simply ask for a full refund within 30 days of the purchase and you will get it – period.

Take advantage of this offer, you guys. I only do this once every year in January, and if you are at all considering real estate investing as a way of changing and improving your financial life, this$236 is the best money you’ll spend and the most value you’ll get!

Please feel free to leave your comments and questions below.

6 Comments