To tell you the truth, I’ve resisted writing on this subject for some time. There are two simple reasons for this. One is that the topic of depreciation is really rather dry; there is nothing sexy, motivational, or exciting about it. Actually, some would say that it’s flat out boring…

Who wants to read a boring article? How many people can I draw into this conversation if the article is boring? A boring article certainly wouldn’t do anything for my standing as an engaging writer, nor would it do much for this website’s SEO…

Real Estate Depreciation is an Important Concept

Having said this, however, the subject matter that I will be discussing, while not particularly sexy, is important. Therefore, there is nothing left for me to do but to make it as engaging and appealing as I can – I love a challenge! So here it is, depreciation in real estate investing and what it means for taxes. This article will give you a complete picture of the subject.

The other reason I’ve been putting this off is that the subject of Depreciation is a conceptually tricky subject, comprehending of which can necessitate rather good understanding of mathematics. I’ve always been a little concerned of offending readers who may not entirely comfortable around math.

In the end, though, Real Estate Investing is about math. Those of you who are not particularly comfortable with math – get comfortable! I will do my best to break this down as much as possible, but if you are going to be investing in Real Estate you have to know math – period.

And with this, let’s dig in…

Real Estate Depreciation Overview

The basic concept behind depreciation is the idea that everything ages over time and eventually reaches the end of its’ useful life-span. If you look on a carton of milk that you buy at the store, you will find an expiration date – I wouldn’t recommend drinking the milk, at least in its’ natural form, past this date. Your car eventually will die; your TV will one day burn out; your clothes will eventually have been washed one time too many; computers, watches, phones, and even you and I…everything has it’s useful life-span!

The application of this reality to the world of business is that every piece of equipment unitized in business also has a useful life-span. In some cases it is easier to note the “expiration date” than others. For instance, it is easy to note when a light bulb burns out, roof leaks, drill breaks, or the computer smiles at you for the last time. In these cases it is necessary to go out and spend money to replace the “expired” item.

In other cases it may be less apparent that an item has outlived its’ usefulness. Imagine, for example, that the drill is not working not because the drill itself is broken, but because the battery that came with the drill is no longer able to hold charge. In principal, since the drill itself is OK, you could go out and buy a replacement battery. But, if this is a seven year-old drill and a replacement battery is going to set you back $120, would you do it? For this money you could buy a rather nice new drill, complete with 2 batteries and some drill bits.

Indeed, most people would elect to retire the old drill and replace it with a new one, and thus, even though not technically broken, the old drill will have reached the end of its’ useful life.

The long and the short of it is the fact that everything we use in our businesses, from a pen to a multi-hundred thousand dollar piece of equipment can only last for so long before needing replaced.

Useful Life-Span and Real Estate Depreciation

Here’s the thing. We live in a free society in which our government can not arbitrarily tell us what to do; at least it should not. But, there are clearly things that our government wants us to do, one of which is to spend money on, among other things, replacement equipment for our business.

Why? Well – our economy is a consumer based economy. If consumers don’t spend, then the manufacturers and service providers do not eat – simple as that! Let me give you an example:

Every time I replace a water heater in one of my rental units, a lot of people make money. First of all, there is the sales tax on the heater itself, which helps support the social infrastructure of my state. Further, having purchased the water heater, I create a shortage in the supply chain, which means that a factory is going to be able to manufacture another water heater for sale, which drives this factory’s business, which not only pays the worker’s salary, but also earns money for the shareholders who will then go out and spend it, and puts money into the coffers of IRS in the form of all types of taxes.

And then, of course, there is the plumber whom I will pay to do the work, and who, having earned the money, will pay into the Social Security system as well as the federal, state, and local income taxes.

So you see, my spending the money on my business has far-reaching positive implications on the local and national economy. This is why our government wants to do what they can to incentivize me and other business to spend. How do they do it? They do this by allowing me to deduct the cost of the expense against the income from my business, thereby “sheltering” a portion of the income from taxes…

Real Estate Depreciation Example

To understand this better, you must realize that the over-all schematic of taxation is different for businesses than individuals. All things being equal, individuals are taxed on their gross income, leaving us to spend what is left. On the other hand businesses are allowed to deduct their expenses and are taxed what is left.

This reality, by the way, makes it much more advantageous to earn money as a corporation but that’s outside of the scope for this article. For now, simply realize that the ability to “depreciate costs” pre-tax is hugely advantageous.

A few numbers:

Let’s say for example that you need some rubber bands for the office, which cost $3. If, for example, your business earned $20,000 this year, than having deducted the expense of the rubber bands your Taxable Income would be $19,997 – this is the amount that the IRS would base your income tax on:

Simple – right? Everyone is happy; you need the rubber bands to run your business so you would have spent the money any way. But this way you at least get a break on your taxes, which makes the expense not as intolerable. The IRS, realizes that your purchase helped to contribute to the economy, as earlier discussed, is willing to give you a break. Besides, in this case, the IRS still gets paid enough to keep ‘em happy. But, let’s see how all of this applies to Real Estate:

How to Deduct the Expense of Purchasing a Building

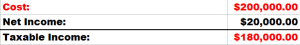

Let us say you’ve paid $200,000 for a nice 6-plex which throws-off $20,000 of Cash Flow per year (let’s just keep the numbers easy):

As you can see, the net taxable income in this case would be a whopping negative $180,000 – a loss! This means that not only would you not pay any taxes on this year’s income at all, but it would be 10 years before you pay any taxes…WOW!

Well, what can I say? The IRS is a rather benevolent bunch, but the notion of not receiving any money from you for the next 10 years does not jive well with them. Are you surprised?

So, what do they do? They split the difference, and in lieu of allowing you to deduct the entire $200,000 expense in one year, they devise a formula to brake this amount up over a number of years, and they base the number of years on what they believe to be the useful life-span of the item.

Residential Real Estate Depreciation Period

For instance, residential real estate is most commonly depreciated in over 27.5 years, because somebody at the IRS decided that the useful life of bricks, mortar, and framing is 27.5 years.

Most of the time, the property is depreciated in a straight line, although it does not have to be, which means that the initial depreciable expense is divided evenly over 27.5 year and each year 1/27.5th is applied.

Few more numbers:

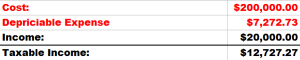

In the case of your new 6-plex, therefore, the depreciable amount in the first year will only be 1/27.5th of $200,000, which is $7,272.73.*

*Actually, since land is not depreciable, your basis for the first year will be the portion of your purchase which is allocated to the actual structure and not the land underneath the structure. But, for the purposes of this example, let’s just keep our basis as $200,000.

Thus, as you can see below, you are going to be left with taxable income of $12,727.27. This is what will be the basis for your income taxes:

More Details on Real Estate Depreciation

1. While a residential structure is depreciated over 27.5 years, commercial structures are depreciated over a longer period – consult your CPA.

2. Land is not a depreciable expense. The IRS has got the message that God quite making land a while back, and as such dirt is finite commodity, which gains value proportionally to growth of population. This means that depreciation is not based on the purchase price, but only the portion which accounts for the structure and not the land – consult you CPA.

3. While most people indeed utilize this tax shelter, you are not obligated to take the depreciation – consult your CPA.

4. A water heater or floor covering is depreciated over a much shorter time-frame since the useful life-span of these items is considered much shorter – consult your CPA.

5. In some cases, you can bypass having to depreciate certain items and take the entire loss for some items in the year in which you incur the expense – consult your CPA.

Great – you get to hide income from the IRS; Legally!

In the above example of a 6-plex, having put $20,000 of Cash Flow in your pocket, the ability to depreciate the cost of the building has allowed you to “hide” over $7,000 from income tax – LEGALLY! Let’s look at this more carefully…

How to Determine Your Effective Tax Rate

The term Effective Tax Rate refers to a relationship of over-all tax paid to the income. In our example whereby you earned $20,000 of cash flow, if we were to assume a 15% tax rate, the exposure would be $3,000 – $3,000 is 15% of $20,000.

However, because of the depreciation the Taxable portion of the income is only $12,727.27 – this is what you are paying 15% tax on. Well, 15% of $12,727.27 is only $1,909.09. Which would you rather, 1 $3,000 tax bill or $1,909.09. Now, if we juxtapose $1,909.09 against the $20,000 Cash Flow earned, we arrive at a 9.4% Effective Tax Rate. Considering that what we earn matters much less than what we get to keep, the above is a very potent reality.

What I just described is indeed one of the reasons people point to our ability to depreciate as one of the main advantages of long-term investments in real estate. And this barely scratches the surface…

Conclusion on Real Estate Depreciation and Taxes

This was a challenging article to write, as I knew it would be. Depreciation is a difficult concept that is hard to get excited about. But, at the end of the day, investing in real estate is about math! And besides, you need to be able to speak intelligently to your CPA, and hopefully this helps a little.

If you’d like, we can continue this conversation; just leave a comment. Two concepts that I did not touch on here are Cost Basis and Capital Gains. For now, though, I am done…

OK – did this help? Feel free to leave your comments and questions below, and please remember to seek advice of your CPA before taking action on any concept discussed in this article.

28 Comments