INTRODUCTION

I have been investing in income-producing real estate for nine years now. My portfolio currently consists of 28 units which generate Gross Rental Income of about $170,000/year and Cash Flow of around $45,000/year. I don’t flip houses. I don’t wholesale houses either. I don’t do Sub2 or Lease/Option sandwich deals or any other fancy VooDoo real estate investing technique which aims to control property contractually but without ownership. No – I am boring indeed. I own every one of the units by way of Fee Simple Absolute Title, as in – I am the owner of record. Furthermore, I own my portfolio singularly and without partners – 100% ownership. I specialize in creative finance with the aim of achieving 100% financing on everything I do…

My experience and successes over the years have proven in my own mind that income-producing investment real estate, which is a glorified way of saying real estate which generates rental income, is truly a prodigious and yet practical path toward wealth generation. People who have money can build wealth and earn a living with rentals, but people who have almost nothing can do it too. Healthy people can build wealth and earn a living with rentals, but it also works for those of us who struggle with health, of which I am an example. Real estate truly offers the best opportunity for wealth creation across the board, and the only precondition – the only common thread is KNOWLEDGE. Yes indeed, I did not start out with a bag of money, but I did discover that the right kind of knowledge trumps money in real estate, and armed with this realization I dedicated myself to the study of the game of investment real estate.

Download my Free Real Estate Investing eBook Now »

In this article I am going to walk you through a transaction I completed this year and walk you through how I created $100,000 with one real estate deal in one year. Throughout this article, I am going to lay out for you my basic rationale around real estate investing and do my very best to expose the perspective that allows me to see and do the things that I see and do. I will cover the basics without which you’d be ill equipped to receive what I am about to teach you, and I’ll zero-in on the specifics of the case study. I will describe what I saw before the closing, what I did in order to close, the financing package, and finally my approach to management which in the end will reposition this project from what it was at the time of acquisition into what it is meant to be.

My main intention for this article is to use a case study in order to convey to you the essence of how to build wealth with rentals. If I do my job well, when I’m finished you’ll say – WOW, and you’ll go out there, buy your first building, and begin to build wealth with rentals in a purposeful, controlled, and pragmatic fashion.

LAYOUT

In order to ensure that you are able to derive the most value out of this discussion, it is necessary that you are aware of and at least some-what understand all of the applicable methodology, as well as my specific perspective on real estate investing. To this end, you will notice sections entitled DICUSSION POINTS sprinkled-in throughout this article. Please do not skip over them; read the content in these sections carefully as this will enhance your comprehension of the subject matter.

And now, to set the scene and get the juices flowing in the right direction, allow me to paint the big picture for you in very broad strokes. This is a quick run-down of the facts, which will be followed by an in-depth discussion. Here we go…

THE BIG PICTURE

I closed on this deal in February of 2013. Incidentally, I first became aware of this opportunity about nine months prior to closing when a local realtor brought me the deal. Let me say that again – the Symphony Deal took nine months to close! Having not started out as a doable deal, it became one when the seller’s circumstances allowed for it – there’s a lesson in that, wouldn’t you say?

This is a 10-unit apartment building, actually two 5-units sitting next to one another. The buildings were built in 1980. They are situated in a desirable area – people want to live there, and can afford to live there. The buildings are 2-story. The units are town-homes. They are all-electric. Both electric and water services are separately metered. However, trash and sewer are both paid by the owner. The buildings showed some amount of delayed maintenance, but not too bad. However, there were a few significant plumbing issues to be addressed right away, as well as the shingles on one of the buildings were original and needed to be replaced in short order.

The Gross Income at the time of acquisition was $5,805/month and the NOI (Net Operating Income) was $3,406/month, which justified a value of around $408,000 at a 10% Capitalization Rate, which is appropriate for a building of this character (More on this later). Having paid $373,500 I received a discount against the capitalized value which I thought was fair relative to the physical and operational circumstance of the asset. Of the purchase price of $373,500 I was able to finance a total of $354,825, which represents 95% LTV. With my financing in place, the Cash Flow after debt service stood at about $1,035/month – basically $100 per door.

That was then…

Today, less than a year later, this 10-Unit is bringing-in Gross Income of $6,265/month, and the NOI currently stands at about $3,871/month. Current Cash Flow is right around $1,500/month, which is $465/month more than at the outset. Based on the current NOI, the capitalized value is now $464,630; this is $91,130 higher than the purchase price of $373,500, and considering that the outstanding debt in this deal currently stands at around $354,000, my current equity position is around $109,805!

And lastly, you may be interested to know that my cash out of pocket at closing was around $5,300. If my math is correct, and I’d like to think that it is, $5,300 out of pocket represents 1.5% of the acquisition price…

OK – now that I’ve hopefully wet your appetite by showing you the completed cake, on a platter and with frosting on top, if you would like to follow me into the kitchen, I’ll show you the inner workings of how we build wealth with real estate and how I created $100,000 with one real estate deal in under one year…

CRITERIA FOR ACTION – THIS IS WHERE IT ALL BEGINS

I average one deal per year, and some years not even. This is partially due to the fact that the type of projects that interest me simply take time accomplish, but mostly it’s because my criteria for action is very specific indeed, and I will NOT take action unless all of the criteria is met. Let us cover the basic elements of my criteria for action:

In my world of multi-family income-producing real estate, I take action only if:

- The deal shows a minimum of $100/door of Monthly Cash Flow on day 1 with the assumption of 100% financing.

- The deal possesses attributes of expandability (I’ll discuss this in a bit).

- The deal lends itself to creative financing opportunities – preferably 100% financing, or close.

$100/door of Cash Flow

We buy income-producing real estate for the income it represents. In my experience, $100/door of monthly Cash Flow in a multi-family circumstance is the bare minimum necessary to achieve safety, flexibility, and satisfactory rate of return.

To take this a step further, while most investors tend to assume $100/door after having made a sizable down-payment, in my opinion $100/door of Monthly Cash Flow should be achieved assuming 100% financing. This means that even if your plan is to put some money down, you should run your numbers based on 100% financing. If the building meets this threshold, then chances are it will safely cash flow through the years, if not – stay away!

Download my Free Real Estate Investing eBook Now »

Expandability and Creative Financing

Having established the minimum threshold of $100/door of Monthly Cash Flow, it is important to realize that this is in fact the absolute minimum – it is the starting point for further analysis. However, a deal truly becomes interesting to me only if it possesses attributes of something we refer to as expandability – let me explain:

Expandability is most easily understood as any tool, technique, contract term, or approach implementation of which allows an investor to either improve upon the investment returns on a given investment or portfolio of investments, or facilitates a transaction which would otherwise not be possible. Expandability items cover a gamut ranging from the setting of the closing date, to financing terms, promissory note clauses, rehab items, and everything in-between. For example, if the deal really can be financed 100%, which certainly facilitates an easy entrance, and if the Cash Flow can in fact be improved from $100/door to say $130 – $150/door, then it can be said that there are multiple attributes of expandability present in the deal – and then I am really interested…

Thus, it is expandability that in fact facilitated my purchasing this building with 1.5% cash out of pocket, and it is expandability that allowed me to increase the cash flow by 50% and drive the valuation up by $100,000 in less than one year. And it is important to understand that expandability is the prerogative of the real estate market almost exclusively due to the notion that unlike most other markets, real estate is an inefficient market. Read more on this here.

HOW SYMPHONY DEAL CAME TO BE

This property was not a listed in the MLS. The owner didn’t want to officially tie himself into a listing agreement, and the realtor was simply trying to help out a friend who needed out knowing that she’d get paid if she actually put the deal together. At that time, the asking price was about $475,000. The three of us met to discuss options, but were unable to come up with a workable solution. About nine months later the same realtor mentioned to me that the seller truly needed to sell and was prepared to discuss a lower price, at which time I told her that at around $350,000 we would have options to discuss.

About an hour later the three of us were sitting down one more time. I knew, because I looked it up in the county records, that the seller had paid $400,000 for the building a decade ago, which meant that accepting my offer would require taking a loss. However, I felt that $35,000/unit was a respectable place to start based on the current income structure, condition, and tenant base and knowing that the underlying mortgage on this building would have had to have been a 20-year amortized loan, I projected by working the numbers backwards that the outstanding balance on the seller’s underlying was low enough to enable him to take my offer if he chose to do so. As you know by now, in the end I met him half way at $373,500.

DICUSSION POINTS: Your capacity to be successful in real estate is directly proportional to your ability to solve people’s problems. The simple truth of the matter is that unless you buy foreclosures and REOs and that’s all you do, in order to structure deals that work you will need to learn to cater a solution to the seller’s problem, and in order to do that you’ll need to first discover what that problems are in a given deal.

Well – as you can imagine, or may be not, the most effective way of getting to the bottom of this is to be face to face with the seller. This can be difficult to accomplish when working with sales agents, but it is virtually a must in my brand of real estate investing! This is why the three of us were at the table – the agent knew that I wasn’t going to play the typical “stab in the dark” game. Face to face is how we pick up clues in the negotiation which expose the problems and lead to solutions…

FINANCIALS AT THE TIME OF ACQUISITION

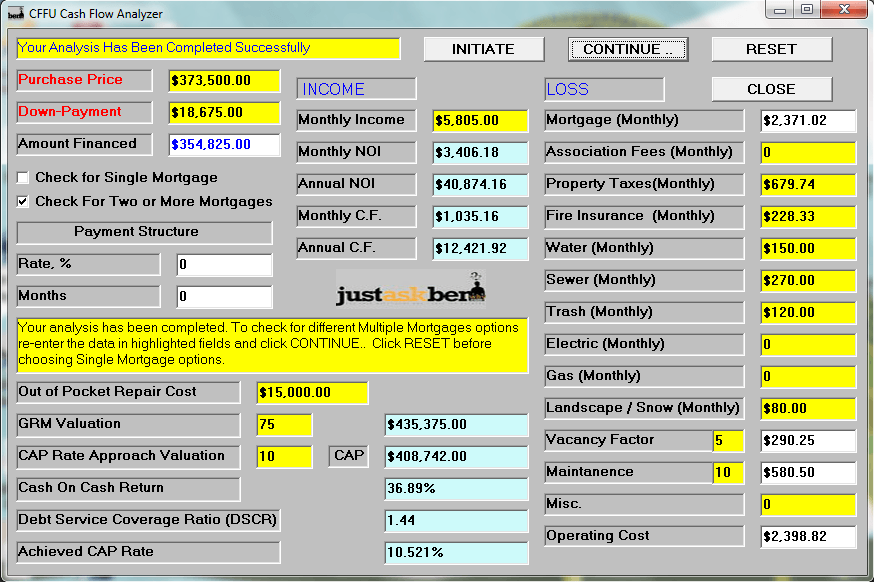

What you are looking at is the final frame of the CFFU Cash Flow Analyzer software which is available as a bonus with Cash Flow Freedom University. It is a BETA version at the moment; nonetheless, it is a pretty handy tool (you can see it in action here).

As you can see in the top left corner, the purchase price was in fact $373,500. The down-payment that I entered into the software was $18,675, which constitutes 5% of the purchase price. Of course if you read the beginning of the article carefully, you know that I did not need this amount in cash to close; I only needed a bit over $5,000 – I will discuss why not in the section entitled THE FINANCING PACKAGE. However, it is important to understand that there were several lenders in this transaction and they had agreed to finance 95% of the purchase which amounted to a combined debt of $354,825, and resulted in a combined monthly Mortgage payment of $2,371.02, which you can see it in the right column at the top.

The rest of the Monthly Operating Costs, as you can see at the bottom of the right column, amounted to $2,398.82, which left the Monthly Net Operating Income (NOI) of $3,406.18. The Monthly Gross Income at the time of acquisition stood at $5,805, and the all-important Monthly Cash Flow after debt service stood at $1,035.16 .

DISCUSSION POINTS: Just to make sure that we are on the same page here, the formula for NOI is:

NOI = GROSS INCOME – OPERATING COSTS (NOT Including Debt Service)

The formula for Cash Flow is:

CASH FLOW = NOI – DEBT SERVICE

We buy income-producing real estate for the income; more specifically the Cash Flow – what’s left in the account after we pay all of the bills, including the mortgages. Naturally, therefore, Cash Flow is a very important metric to us. However, because the Cash Flow metric includes Debt Service which is different from one investor to the next depending on the financing package in place, it is not a good metric to go by when trying to gain an “apples to apples” assessment of the value of the building as a function of its income.

Therefore, a more universal metric of income is needed, and it is the NOI. After all, while every investor will finance the purchase differently resulting in different Debt Service and Cash Flow, all of us in equal measure will have to contend with the other costs, such as property taxes, vacancy, maintenance, landscaping, etc.

The NOI, which accounts for all of the costs of ownership aside for Debt Service allows us to have a very clear picture of the Income & Expense structures of the building – irrelative of the financing package…more on this in a bit.

If you did not know these definitions prior to reading this section just now, it may not be a bad idea to go back and re-read the opening sections of the article 🙂

THE FINANCING PACKAGE

I started this article with the assertion that real estate represents the most practical vehicle for wealth generation for most of us. One of the main reasons for my assertion is something called leverage – an ability to bring a few dollars to the table and to supplement, or leverage them with a lot of OPM (Other People’s Money). Leverage, in and of itself, should be thought of as and element expandability:

The degree to which leverage opens doors for us is directly proportional to our intellectual worth in the matter. For example, it is very common and does not require any particular ingenuity for an investor to achieve 70% leverage whereby he would be required to make a 30% down-payment while the lender would provide the rest. 75% or even 80% leverage are also commonplace.

Granted – either of the above is much better than having to come up with all cash; not a lot of us have $400,000 laying around. However, had I needed to bring a 20% down-payment to this deal, it would have been almost $75,000 out of pocket! Fortunately, with some know-how in the arena of creative finance, real estate offers opportunities for higher leverage than 80%.

In fact, the Symphony acquisition financing package showcases my ever-present desire to achieve as close to 100% financing as possible. Cash is an expensive commodity which I believe should only be used to create more value than that which it stores in itself. For example, if I can use $10,000 to create $30,000 worth of value, then I do it. But, if spending $10,000 only creates $10,000 worth of value, then what’s the point?

The later is how I see making down-payments (more on that in the next DISCUSSION POINTS section). While I wasn’t able to achieve 100% financing on the Symphony deal, I came very close. Here’s how:

My commercial banker financed 70% of this acquisition. This loan was nothing special – a 20-year note with 5-year adjustments; standard for the industry. However, what really made this deal work for me is that I was able to obtain a private loan for 25% of the purchase price – that was huge; it made the deal affordable for me. This private loan was collateralized with a Promissory Note and Mortgage, just like any other conventional real estate loan, however, what made this different is that we used what is called a Blanket Note which pulled equity from other property that I own – this is one of the tools I’ve been known to use quite at times.

Now – to further describe to you the dynamic, I’ll tell you that my commercial banker typically finances acquisitions such as this at 75% LTV (Loan to Value, which is basically the same thing as leverage). However, because the bank knew that I’d be financing above and beyond that, they declined to go above 70% LTV, and further stipulated that even though I had the capacity to finance the entire 100% of the deal, that I should put 5% of my own “skin in the game”.

Well, I think you would agree that in a world where most people would have had to come to the table with a 25% down-payment ($93,375) for a deal like this, 5% was a rather an attractive proposition in and of itself. Having said that, though, 5% of $373,500 is still a pretty cool $18,675, and while I could have done it, I didn’t want to for various reasons, some of which I’ll discuss in the next section. Luckily I didn’t have to because after the proration of rents, and a few other negotiated items all of which were applied to the closing statement, all I needed to bring to the attorney’s office was a check for about $5,300. Thus, even though my down-payment requirement was 5% on paper, all I actually needed was a bit under 1.5% of cash to purchase Symphony! This was a good thing, because the money that I kept from having to make that down-payment in cash was put to much better use – keep reading…

Download my Free Real Estate Investing eBook Now »

DISCUSSION POINTS: I need to segue for a few paragraphs into a discussion of down-payments. The best that I can tell there are 3 reasons why people commonly feel that making a large down-payment is either necessary or desirable. These reasons are:

- Down-payment is required by the lending entity.

- Down-payment facilitates greater cash flow.

- Down-payment facilitates stronger equity position and safety.

First – while it is true that a down-payment may be required by the primary financier on the deal, what is also true is that we are free to try and finance the down-payment in some way, and relative to creative financing there may be a multitude of tools that we can use to accomplish this, such as the Blanket Note with an Umbrella Mortgage that I used on this deal. Unfortunately, a more in-depth discussion of this topic is not possible within the framework of this article. Suffice it to say that for me personally a large down-payment is completely out of the question; not only because I don’t just have $93,375 laying around, but also because it goes against my investment philosophy, which brings me to the second item on the above list.

Now – I hear people say things like if the cash flow is a little thin, just put more money down. This to me is so utterly convoluted on so many levels. First, as far as I am concerned if the cash flow is not strong-enough under 100% financing, then the deal is just not good enough – period; in which case throwing more money at it is akin to throwing good money after bad. Why would anyone think that this is a good idea?

And secondly, buying down the mortgage and freeing up cash flow by way of a lower debt service payment is nothing more than buying cash flow. I firmly believe that as sophisticated investors we have no business – ever to be buying cash flow. WE CREATE CASH FLOW – we don’t buy it, and in this article I’ll show you exactly how!

Finally, there’s that issue of putting money down to create instant equity and with it safety. Suffice it to say that my current equity position in this building is a bit over $100,000 – and I didn’t buy it with a down-payment; I created it, and in the next section I’ll begin showing how I did it..

HOW TO BUILD WEALTH WITH RENTALS – MY STRATEGY

As I established earlier, the Cash Flow on day 1 appeared to be $1,035.16, which met my guideline of $100/door on this 10-Unit. However, the true value in this transaction lay in my belief that I could increase the Cash Flow quite substantially and with it increase the value of the property itself. As you by now know, the value of income-producing real estate resides in the income – we buy this type of real estate specifically for the income it represents. Therefore it makes sense that we place value on a property relative to the income stream it represents – the more the income, the more we are willing to pay.

For example, if you’ve decided that you are willing to deploy capital so long as you can achieve a 10% ROI (Return on Investment), then a property which generates a return of $12,000/year would be reasonably worth to you $120,000 ($12,000 is 10% of $120,000). If, however, you’ve decided that you need a minimum of 12% ROI, then for the same revenue stream represented by the same property you would only be willing to pay $100,000. In this example, the 10% ROI and 12% ROI are examples of something we call in real estate the Capitalization Rate (CAP Rate), while the $12,000/year return is actually the all important NOI which I discussed earlier.

Now – the CAP Rate is most easily thought of as the rate of return that most reasonably aggressive investors are able to achieve on specific type of property in a specific marketplace. Thus, if you ask 100 investors in small multi-family what CAP Rate they are achieving (what CAP Rate they are satisfied with), and you get answers in the range of 9% – 10%, then you know that the going CAP Rate in a given marketplace for a particular style of building is around 9.5%. The formula for CAP Rate is:

CAP Rate = NOI / VALUE

where Value stands for the price that people are willing to pay for the buildings, and NOI stands for the NOI in those buildings. If we invert the formula, we can determine value based on a given NOI and CAP Rate:

VALUE = NOI / CAP Rate

Thus, a building generating $12,000 of Annual NOI is worth $120,000 in a marketplace where the going CAP Rate is 10%. However, the same building with the same NOI would be worth $240,000 in a marketplace where the going CAP Rate is 5%, and $60,000 in a marketplace where the going CAP Rate is 20%.

How this can be used to your advantage?

Simple – since what effectively sets value in the income space is the NOI, logic would have it that if you, the investor, are able to improve the NOI, you’ll be able to back into increased valuation relative to the same CAP Rate. For example, let’s say that having bought the building I mentioned above which generates $12,000/year of NOI, you are then able to increase the NOI buy $300/month ($3,600/year) – what happens then…?

Well, first – your research revealed that the going CAP in our marketplace is 9.5%, so we sill base our calculations on that. This means that as it was at the time of acquisition, the $12,000 of Annual NOI constituted a value of $126,315 in this marketplace:

VALUE = NOI / CAP Rate

VALUE = $12,000 / 9.5% CAP Rate = $126,315

Now – if we plug the the extra $3,600 of annual NOI in the formula, we can see that with this additional income the building is now worth $164,201 at the same 9.5% CAP Rate (which your research revealed is indeed the going CAP Rate, and therefore the rate any investor and/or appraiser would use to valuate this building):

VALUE = NOI / CAP Rate

VALUE = ($12,000 + $3,600) / 9.5% CAP Rate = $164,210

Therefore, if you are able to find a motivated seller and outdo the marketplace by buying this building at say a 10.5 CAP, which would constitute a purchase price of $114,285, and then you are able improve the NOI by $3,600/year and thus improve the value to $164,210, you would gain about $50,000 of equity. Now – you may have to season the building a year or two, but the bottom line is that when you decide to sell or refinance, your potential buyers/appraisers will be analyzing the building exactly as I described, and presuming the going CAP Rate in the marketplace for a building of this character remains at 9.5% they will be looking at a value of $164,210. They may adjust it for this, that, or the other, but this will be in the ball park.

This means that not only you could sell at a discount from the capitalized price and still make quite a nice pay-day, but you would have the option of refinancing to get all or a lot of your original investment out. And besides, most of that newly found NOI would flow directly to your Cash Flow…Enjoy!

What I described above is how fortunes are made in income-producing real estate, and it is how I created $100,000 with 1 real estate deal in under 12 months. This, in essence, is my strategy on every deal I do. Let’s now consider the specifics of what I did with the Symphony 10-Unit and the results:

ANTICIPATED STABILIZED FINANCIALS

First of all, when buying the building I was aware that the rents were too low. I own other buildings in the area and know the marketplace well, as I think that you should prior to pulling the trigger on an acquisition. I wasn’t sure how much I would be able to drive the rents up, or how long the process would take, but I knew there was room. Also, it was my opinion that the property taxes accessed were much too high, and while I wasn’t sure if I’d succeed, I was going to try to lower them. The rents and property taxes were my primary expandability items in this deal.

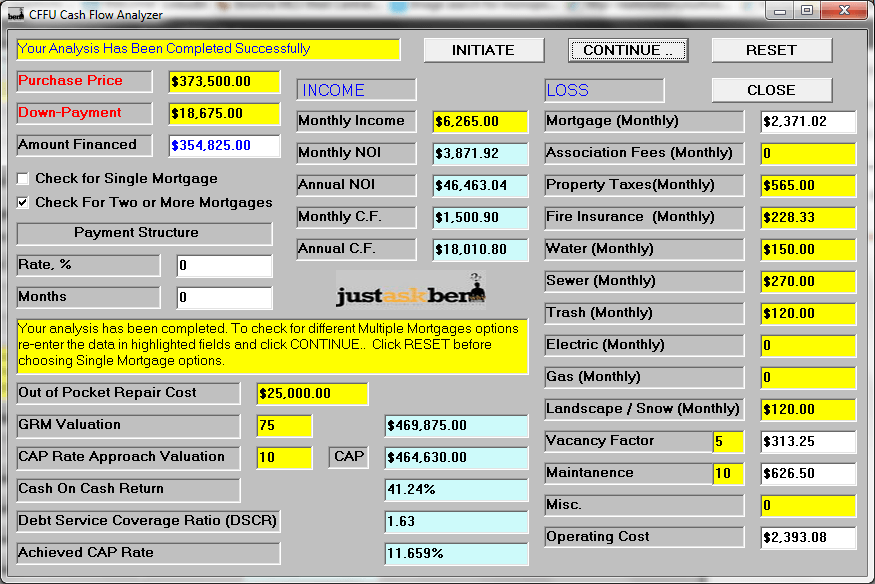

As you can see above, I project the stabilized Monthly Income to be around $6,265 – up from $5,805, which constitutes an improvement of $460/month. Also, I have already been able to indeed lower the property taxes from $679.74/month to $565/month, which is an improvement of about $115/month. All and all, this will result in $575/month of additional spread when fully stable!

Not all of it will flow to the NOI though. If you compare the stable NOI of $3,871.92 to the NOI at the time of acquisition of $3,406.18, you will realize that the improvement is only $465.74 and not $575. The difference is in 3 items:

- Originally I planned on landscaping to cost $80/month, but as it turned out I am having to pay $120/month.

- The Vacancy Factor and the Maintenance are a direct percentage withholding from the Monthly Income. Thus, as the income goes up, so does the dollar amount for both of these items.

Having said this, as you can see above, the entirety of the $465.74/month increase to the NOI will flow directly through to the Cash Flow, which will go up from $1,035.15/moth to a very nice $1,500.90/month! Furthermore, this increase in the NOI will justify a stabilized valuation of $464,630 at a 10% CAP. I expect this process to take 2-3 years, by which time my outstanding debt on this deal will be under $350,000, which means that my equity position will be over $100,000…!

WHAT IT TAKES, AND WHAT IS THE POINT?

Well – what can I say? What it takes is a lot of work – A LOT! I’ve evicted bums; I have been spending a lot of money on CapEx and general maintenance; and I am placing better tenants. I anticipated for this process to cost about $15,000 and take 2 years, which would have meant that I would have been able to pay for it largely by re-investing Cash Flow. Instead, I ended up spending $25,000 in the first year, which meant that I had to raid my reserves more than I had wanted to.

In fact, during the first 11 months of ownership I cleared only about $3,000 on this project. Currently, at the end of the second year of ownership, it looks like I will still only clear $8,000 – $9,000. However, this is because I am still re-investing like crazy into deferred maintenance and CapEx items – about $9,000 in year 2. The building is slowly stabilizing but when fully stable this spending should come down to about $4,000 instead of $9,000, thereby adding the difference to my Cash Flow and bringing it to $14,000/year. And finally, while I’ve been slowly raising rents, there is more room for additional income.

In the end, I even if I don’t reach my stated goal of $1,500 CF per month, I will get close. So – is the work worth it? I think so…wouldn’t you agree? Here are some before and afters:

I plan on owning this building for many years and benefiting from the Cash Flow that it represents…

Why did I do it? Well – for one thing $1,500/month of Cash Flow has never hurt anybody, and even if it only ends up being $1,250/month I will be just as happy. But, it is also important to understand that in the world of creative finance, the $100,000+ of equity creates opportunities for leverage. For instance, in my world I can go out and borrow $50,000 against this equity and bridge it into the next building, while the increased Cash Flow from this building will more than cover the cost of borrowing the money.

So you see – I’ve created options for myself. I can simply enjoy the Cash Flow and Equity and know that if I needed to sell quickly, I’d be able to come off of the reasonable capitalized value by as much as $75,000, and still walk away with my shirt on my back. Or, I can be more aggressive and bridge some of this equity into acquisition of another building, which will add more equity and cash flow to my portfolio…

A BIT MORE PERSPECTIVE

Well – before I conclude this article, won’t you join me in having a little fun. Imagine for a moment that every number in the above transaction was multiplied by 10. In lieu of 10 units, I’d be talking about 100 units, and in lieu of $373,500 purchase price – $3,735,000 purchase price. I’d be talking about acquisition of a 100-unit apartment community – wouldn’t I? I would also be talking about increasing monthly Cash Flow from $10,000 to $15,000, and increasing the equity position not by a mere $100,000, but by a cool $1,000,000 – in one deal!

Oh yes my friends – the numbers work exactly the same way whether the deal is a 10-Unit or a 100-Unit. This is precisely why as likely as anything else, the next deal that I will be involving myself with will be a syndication deal necessitating pooling money together via a Private Placement Memorandum according to Regulation 506 D. Might as well – it makes sense to go for a $1,000,000 rather than $100,000 while we are at it. Would you like to learn more? Send me an email here…

CONCLUSION

Wow – this ended up being a very long article. I hope you are still awake 🙂 I did my best to pack this post with tons of actionable content for you. Put very simply, what I did with the Symphony deal is I spent $30,000 to create $110,000 of value on my Balance Sheet and $1,500/month on my Income Statement.

OK – I know what you may be thinking: where am I going to get $30,000 to do a deal like this? But that’s the thing – yes we need money to play the game, but it doesn’t have to be our money. Get a partner; Syndicate the deal; do something. Even if you get a small piece of the pie, it’s better than no dessert – remember this?

The question you should ask yourself is this: What kind of knowledge should I have in order to be able to attract money? In other words, why should somebody with money and options choose to go ahead with your program…?

And the answer, of course, is very simple – because they like you, trust you, and believe that you are very good at what you do and will perform as agreed upon. So – the money is indeed a problem in Real Estate, but it’s not your biggest problem. What you need is knowledge – you need to gain a capacity to see what other people can’t. When you know enough, the money will come, and this is what makes Real Estate the most prodigious investment vehicle for you and me!

I hope you’ve enjoyed reading this article as much as I’ve enjoyed writing it. Feel free to leave me a comment in follow-up to anything you’ve read!

UPDATE_June 5, 2016

It’s been some time since I’ve written anything about the Symphony deal, and I thought you would enjoy knowing how my projections materialized into reality. So – here’s a little update:

As I stated at the top, my in-place projected cash flow showed at about $12,500, and my hope for the re-positioned asset was around $18,000 of annual cash flow and about $75,000 of equity.

Well – 2013 was bad. Not only did I not see $12,000 of cash flow, but I barely broke even! In fact, $3,000 was all that I managed to earn on this project in the 11 months of ownership in 2013. There were a lot more economic losses and CapEx than I anticipated. Things were so bad, in fact, that I was wondering whether I’d made a mistake…

2014

But, 2014 was better. I saw about $10,000 of cash flow in 2014. Most of the bad apples were out in 2013, and a lot of the heavy CapEx was out of the way. In the end, I spent about half as much on economic losses and CapEx in 2014 compared to the prior year, and this resulted in substantively higher cash flow.

Download my Free Real Estate Investing eBook Now »

Frankly, I felt like a huge weight had been removed off of my shoulders in 2014. Why – because considering this was a No-Money-Down deal, $10,000 of cash flow on an annual basis, while not as good as I’d hoped for, would have validated the purchase as a long-term hold. So, 2014 was a happier year 🙂

2015

Symphony killed it in 2015, and that’s all there is to it. I saw cash flow of about $18,000 – this was what I’d hoped for, as I discussed earlier in the article. Think about it, guys, $5,300 cash to close the deal which throws off $18,000…

Not only that, but I was able to refinance the building in 2015, and based on the appraised value $450,000, I was able to wrap the remaining balances on both notes into one, fully amortized note. And, the debt service on the new note is lower than the cumulative payments on the two notes at the outset.

As of now, if my memory serves me correctly, the remaining balance is $358,000, which juxtaposed against the valuation of $450,000 means that I can hang about $90,000 on my balance sheet!

Symphony has now been running stabilized for a year. I will post an up-date in 2016, but all things considered, I am rather happy with the way this deal has turned out. Difficult at the outset, but gratifying in the end!

Credit: Remodeleze via Compfight cc

45 Comments